The U.S. dollar is coming to an end, and so is the banking system as we know it. What we are about to witness will undoubtedly be the greatest financial collapse of our lifetimes and it will make all others pale in comparison. The warning signs are everywhere, and the average person is blissfully ignorant to the fact this is happening. But if you’re watching right now, that means you are in the smart minority. In this video I’m going to outline everything you need to know about this controlled demolition of the financial system, how it will affect cryptos and what we can expect to happen next. This will give you a chance to act and hopefully end up in a better position than most when this all goes down, so make sure you stay till the end and listen to this critical information.

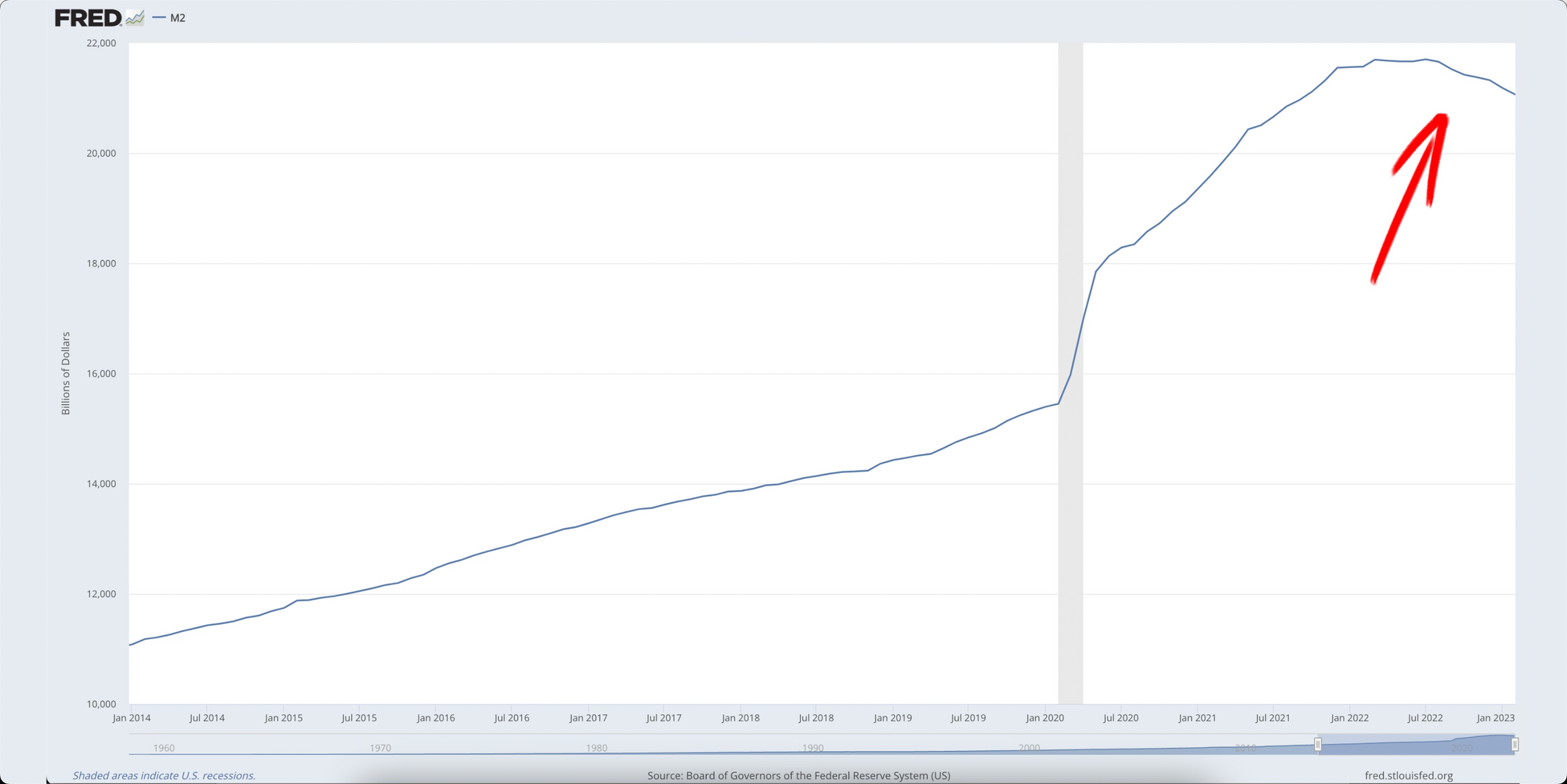

As I’m sure most of you know, the central banking system is a multi-generational ponzi scheme. If you need some background on that, go check out The Hidden Secrets of Money series by Mike Maloney – it’s a must watch. But essentially for decades the system has been kicking the can down the road and delaying the inevitable, it’s collapse, by printing more money to sustain itself. We are now at the end of the road and the M2 money supply has just recently started decreasing. The Fed is reducing the supply while raising interest rates, to curb the high inflation caused by their unprecedented creation of dollars during 2020 and 2021. Historically, negative M2 growth has been a harbinger of great financial panic, and each time it has occurred, the consequences have been dire. The most recent instance of this was in 1930, which marked the beginning of The Great Depression. Such a recession will cause deflation in the U.S. dollar, and the Federal Reserve will respond by lowering interest rates and turning the money printer back on. The dollar will then experience hyperinflation and become practically worthless, a fate that has befallen many other now-defunct currencies throughout history. This is already set in motion, the Fed knows that it is coming and there is nothing they can do to stop it.

This precarious situation combined with a distain for the U.S. government and its foreign policy, has caused a growing number of nations to ditch the dollar in favor of the Chinese Yuan or Russian Rubles when conducting trade. Just days ago, President Xi of China met with Russian President Vladimir Putin to conduct talks which mostly centered around using the Chinese Yuan as a settlement currency. Putin stated that “we support the use of Chinese Yuan in payments between Russia and countries of Asia, African and Latin America. The practice should be encouraged further and mutual presence of financial and banking institutions on Russian and Chinese markets should be expanded”. This comes at a time when two-thirds of the trade between Russia, the world’s largest energy exporter, and China, the world’s largest economy, is done in Rubles and Yuan. These 2 countries are also joined by Brazil, India and South Africa in the BRICS alliance, who have announced their intention to create a completely new currency that is backed by gold. Saudi Arabia has also come out and said they plan to conduct oil trade in currencies other than U.S. dollars. Further, countries all over the globe are reducing their exposure to the dollar by offloading it for other assets. With all this going on, the dollar is losing its global reserve currency status.

Meanwhile, cracks in the U.S. economy have begun to show as a series of multi-hundred-billion dollar banks failedin the last few weeks. While interest rates were basically at 0, banks had been accumulating long-dated treasury bonds from the Federal Reserve. With the Fed now raising interest rates to 5% in less than a year, the banks have massive unrealized losses on their bonds as seen in the chart on screen. This, with the help of the media to hype up fear, has triggered bank runs where customers rush to the bank and simultaneously attempt to withdraw their money. In all cases, the banks don’t have the cash on hand and are forced to sell their bonds. This is when the losses are realized and what has caused these, so far mostly smaller regional banks to implode. You can be sure that more banks will meet the same fate as people start to question whether their money is at risk and try to withdraw. So far, it seems that most people have simply transferred their funds into the larger banks like JP Morgan Chase and Bank of America, because for whatever reason they are deemed to be “too big to fail”. With the influx of new deposits, they have been aided in facilitating demand for withdraws without having to sell bonds at a loss, at least for now. This consolidation of wealth in the big banks is of course, by design. With everyone’s money in a handful of these banking institutions, it makes it easier to implement the next stage of this planned collapse once the dollar is killed off. That is, the rolling out of Central Bank Digital Currencies, also known as CBDCs.

Governments and central banks across the globe have all been signaling that they are getting ready for the transition from fiat currencies to CBDCs. On March 9th, 2023, Joe Biden signed an executive order titled Ensuring Responsible Development of Digital Assets, which directed there to be urgent research and development conducted for a United States CBDC. Less than a week later, the Fed unveiled details about a new instant payments system it had developed, called Fed Now. This system, slated for launch in July, is likely to be a part of, or will help facilitate, a future U.S. government CBDC. So, the people who ran the last scam financial system are going to pose as the saviors and offer a solution to the problem they created. We’ve been hearing about CBDCs in the news for years now, and that has all been part of a marketing campaign. What they won’t tell you is that it’s a tyrant’s wet dream. It is a system of total control that will give governments unprecedented power over all aspects of their citizens’ lives. Not only can they easily see all your transactions, but they’ll be able to dictate where, when, and how much of your money that you can spend. I think it’s quite likely that, if they get their way, we’ll see things like “oh, you’ve exceeded your carbon allowance for the year and now you can’t buy any more meat or animal products”. Similarly, if you say or do something that the government disagrees with, they can shut you off completely from your money and the ability to engage in commerce. That is just scratching the surface of what’s possible in this nightmare system. The level of control would resemble the dystopian society portrayed in Geroge Orwell’s 1984, possibly even exceeding it. Of course, the people pushing CBDCs will say that it would never be used for this purpose. It will be solely about protecting citizens, making our lives more convenient and stopping criminals and terrorists. But from their past actions we know they lie through their teeth, particularly when pushing through an initiative that gives them more power.

It seems unlikely to me that the recent bank failures were simply a coincidence because those banks all had one thing in common. They provided banking services to crypto-related businesses. It would appear that someone is attempting to blow up the on and off ramps between the U.S. dollar and cryptocurrencies. Simultaneously, regulators have begun launching attacks against cryptocurrency exchanges. For instance, the SEC targeted Kraken exchange over their staking services, which resulted in Kraken shutting down that service and paying $30 million in fines. Following that, the SEC issued a Wells notice to Coinbase, which pertained to staking and asset listings, and indicated that they planned to sue. Meanwhile, the SEC has been tweeting warnings that investing in crypto and using platforms where you can buy and sell cryptocurrencies is risky - a classic case of fear, uncertainty, and doubt. Another target of these regulatory attacks has been Binance and its founder CZ, who was charged by the CTFCwith willful evasion of federal law and operating an illegal digital asset derivatives exchange. Interestingly, none of these government departments were ever interested in FTX and Sam Bankman-Fried, responsible for one of the largest cases of fraud in history. I’m sure that’s got nothing to do with the fact that SEC Chair, Gary Gensler, regularly had meetings with Sam Bankman-Fried and had ties with the father of Caroline Ellison, who was the CEO of FTX’s sister company Alameda Research. Nothing to see there and of course there will never be an investigation. Instead, the SEC and CTFC have chosen to go after businesses who have been the most compliant with regulations over arbitrary decisions. Such as the decision to define certain crypto assets as securities when clearly, they are not. This has been done solely so that the government can apply more crippling measures to those assets and companies who deal in them, similarly to Joe Biden’s proposed 30% tax on crypto mining electricity usage.

The U.S. government has declared a war on crypto. They know that their CBDC cannot compete with the likes of Bitcoin or Ethereum. Therefore, they are launching pre-emptive attacks on the industry and attempting to discredit it with situations similar to FTX, which they may have been involved in themselves. With the U.S. dollar is on its last legs, attacks on crypto will only intensify, and it may eventually lead to anything other than CBDCs being outlawed. We must reject CBDCs at all costs and if you haven't already, now is the time to consider loading up on cryptos while you still can. In the long run, they will emerge as the better form of digital money, free from the manipulation of governments and central banks. Check out the video on screen where I demonstrate the best way to buy crypto right now, you don’t want to miss it.