Today I’ll be doing a deep dive into a project that’s been flying under everyone’s radar and which I believe could be a 100x crypto gem you don’t want to miss. That project is called Verse and it is a product of Bitcoin.com. After raising $33M dollars in an early 2022 private token sale, Bitcoin.com launched Verse during the depths of the bear market and thus it hasn’t yet caught the attention it rightly deserves. At its heart, Verse is a utility and rewards token for the Bitcoin.com ecosystem of products, but it is so much more than that. Before I explain, I do want to disclose the fact that I have invested in and hold VERSE tokens. That’s because I see an opportunity for huge upside potential and this video will outline my rationale in coming to that conclusion.

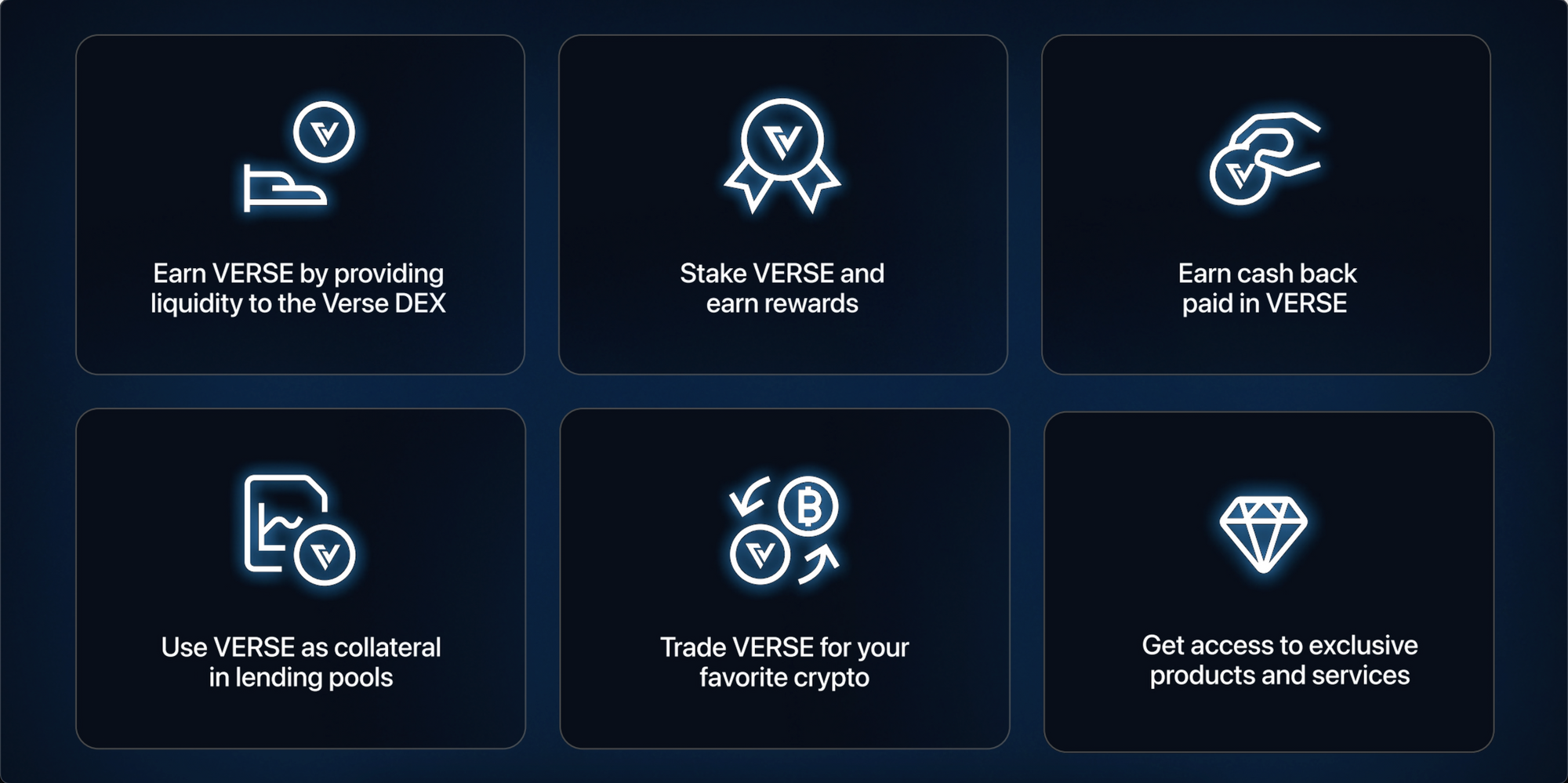

For years now, I’ve been a user of Bitcoin.com’s products, primarily their mobile crypto wallet that has just recently expanded to web browsers. I’ve previously said that this app provides the best user experience for beginners and power user alike when it comes to managing crypto assets, so it’s no surprise it ranks #1 on the app store when searching for Bitcoin. Bitcoin.com also has one of the most widely read news sites in the crypto and financial sectors. Cumulatively, they both attract millions of unique users each month who are now beginning to be exposed to Verse. The ERC-20 token can be earned as a reward for performing tasks in the wallet, as well as for using the soon to be released Bitcoin.com crypto debit card that will allow you to spend crypto at businesses through existing VISA and Mastercard payment terminals. On the news site, people who pay for press releases and ads can use Verse to get a discounted price. With the launch of Verse token also came the launch of Bitcoin.com’s decentralized exchange that goes by the same name.

The Verse DEX is a fork of Uniswap V2 that has all the basic functionality we’ve come to expect in decentralized trading platforms. The team has been pushing out new features as they work through their roadmap, for example the farms page that went live in early February. This is where users can put their money to work and earn more Verse tokens by providing liquidity to the DEX. Currently the APY on their supported liquidity pools is pretty lucrative, particularly on the VERSE and Ethereum pair, so make sure you go and take advantage of that. By going to the analytics page, you’ll see that the total liquidity on Verse DEX has been rising quite rapidly since the launch of farms. It went from under $4 million dollars to $13.5 million in just the last month. This growth has put the DEX rank at number 18 by total value locked on Ethereum, and well into the top 100 when considering all blockchains. Keep in mind Verse climbed from the bottom to the current position in just a few months, during a bear market. When crypto starts turning bullish again, this growth will be supercharged and Verse can become one of the top contenders when it comes to DEXes. Especially when you have such a huge funnel as the Bitcoin.com wallet app, directing millions of users to this DEX and putting Verse tokens in their hands. Many of these Verse token holders become speculators by purchasing more and this will of course influence the token price.

Where the price sits currently, it presents an excellent opportunity for those who believe in the long-term prospects of VERSE. When Bitcoin.com conducted their private sale, VERSE was sold at a price of $0.0016 U.S. dollars. Right now, it’s trading at $0.001 dollars, which means that you can buy it on the open market for nearly 40% less than what insiders paid. Further, public sale buyers got the best deal at about $0.00025. This is because the Verse public sale price was dynamic which means that the price of the tokens allocated to the public sale would go up as buyers put more money in. The sale was held shortly after the collapse of FTX, which created bad sentiment in the crypto market and detracted buyers, which created this unique buying opportunity. This is in stark contrast to other token sales where insiders normally get unfair discounts.

To gauge the future potential price performance of Verse, I’ve compared it against similar projects that have been around for a few years now. From the Verse Whitepaper you can see that it’s comparable to Crypto.com’s CRO or Binance’s BNB. Starting with CRO, you’ll see there’s a bit of a spike in weeks following the launch and then it trends down it trends down for about a year before taking off massively. Then, zooming out to a longer time frame, it went absolutely ballistic when the 2021 bull market was in full swing. From the lows of the first depression to the next high, there was a 3000% price increase. BNB price movements were somewhat similar. Spiking a few weeks after launch and then going stagnant before taking off a year later, and then during the 2021 bull market it also went crazy. This was a 16,500% increase from the lows of its first depression to the subsequent high. These don’t line up perfectly with what we’ve seen on Verse so far, but what I’ve found to be the most accurate comparison would be the Uniswap price chart. Like VERSE, it had an immediate pump upon launch and then trended downwards for many months. As you can see on the Uniswap chart, it was 3 new major lows before it started taking off and ultimately increasing by 2,600%. On the VERSE chart, you could argue that we’ve had 3 of those already, maybe 2. I think there is a compelling argument that VERSE will perform similarly to these tokens, and being conservative you could make price targets based upon the performance of Uniswap.

One thing that’s clear is that in the crypto industry, when tokens get listed on major centralized exchanges, that’s a catalyst for a big pump. At this point in time VERSE hasn’t been listed on any of the major platforms and the team has been keeping tight lipped when questioned about it by the community. I’ll also note that KuCoin was an investor in the VERSE private sale but they haven’t even listed it on their exchange yet. Undoubtedly KuCoin will list it at some point because it’s in their best interest to do so. What I think is happening is that the VERSE team is being strategic in the way they handle their token launch, instead of just rushing out there to get it listed everywhere at the beginning. What I’ve observed is that they have been actively working to form partnerships and get VERSE integrated on platforms that aggregate DEFI data, wallets, analytical tools and other such things. Every month they’ve been detailing this in blog posts and clearly that has been their focus so far, in addition to getting VERSE in the hands of more people. I predict that probably starting soon, they will be in a position where VERSE has enough integrations and awareness that they can shift their focus to exchange listings. When that happens, any pump in the VERSE price will be far more sustainable because it is based upon merit and not just hype.

That’s all I’ve got to say about the current state of VERSE right now and where I think things are headed. It’s not financial advice I encourage everyone to do their own research. If you want to check out Verse, I’ve put a link in the description that will take you there. Also, if you want to learn more about the Verse roadmap, click the video on-screen where I interviewed Bitcoin.com’s head of Financial Services, Corbin Fraser.